Fundamental financial accounting concepts 11th edition pdf – Welcome to the realm of financial accounting, where Fundamental Financial Accounting Concepts, 11th Edition, serves as your guide to unraveling the complexities of this essential business language. This comprehensive resource delves into the core principles, empowering you to navigate the intricacies of financial reporting and decision-making with confidence.

As we embark on this journey, we will uncover the significance of accounting equations and transactions, the role of debits and credits in recording financial events, and the anatomy of financial statements—the balance sheet, income statement, and statement of cash flows.

Along the way, we will explore the purpose of adjusting and closing entries, gaining insights into their impact on financial reporting.

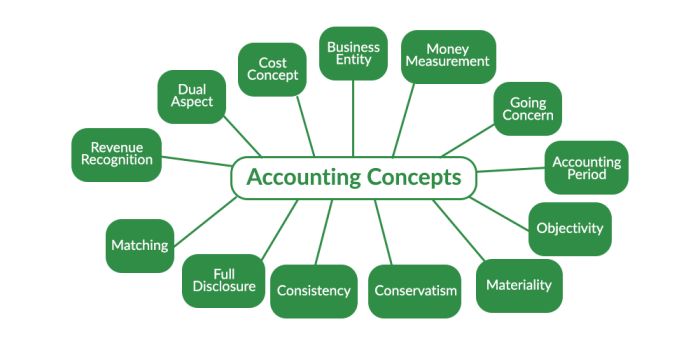

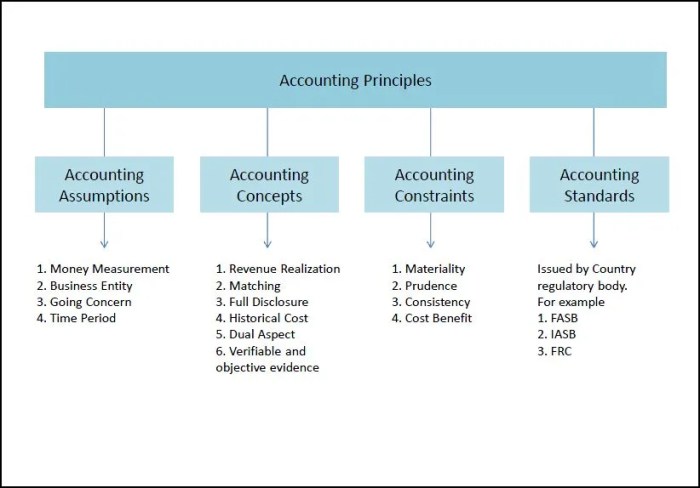

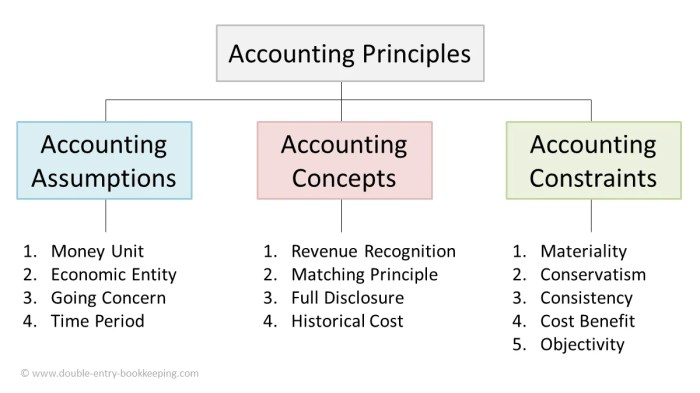

Key Accounting Concepts

Accounting is the process of recording, classifying, and summarizing financial transactions to provide information that is useful for decision-making.

The fundamental principles of accounting include:

- The accounting equation: Assets = Liabilities + Equity

- The revenue recognition principle: Revenue is recognized when earned, not when cash is received.

- The matching principle: Expenses are matched to the revenues they generate.

- The going concern principle: The company is assumed to be a going concern, meaning it will continue to operate in the foreseeable future.

Debits and credits are used to record transactions in accounting. Debits increase assets and expenses, and decrease liabilities and equity. Credits increase liabilities and equity, and decrease assets and expenses.

Financial Statements

The three main financial statements are the balance sheet, income statement, and statement of cash flows.

The balance sheet shows the company’s financial position at a specific point in time. It lists the company’s assets, liabilities, and equity.

The income statement shows the company’s financial performance over a period of time. It lists the company’s revenues, expenses, and net income.

The statement of cash flows shows the company’s cash inflows and outflows over a period of time. It helps investors and creditors understand how the company is using its cash.

Adjusting Entries

Adjusting entries are made at the end of an accounting period to update the financial statements for transactions that have occurred but have not yet been recorded.

Common adjusting entries include:

- Depreciation: Allocating the cost of an asset over its useful life.

- Accruals: Recording expenses that have been incurred but not yet paid.

- Deferrals: Recording revenues that have been received but not yet earned.

Adjusting entries ensure that the financial statements are accurate and up-to-date.

Closing Entries

Closing entries are made at the end of an accounting period to close the temporary accounts (revenue, expense, and drawing accounts) and transfer their balances to the permanent accounts (assets, liabilities, and equity).

Closing entries ensure that the temporary accounts have a zero balance at the beginning of the next accounting period.

The Accounting Cycle

| Step | Purpose |

|---|---|

| 1. Journalizing | Recording transactions in a journal |

| 2. Posting | Transferring journal entries to the ledger |

| 3. Trial balance | Checking the equality of debits and credits |

| 4. Adjusting entries | Updating the financial statements |

| 5. Adjusted trial balance | Checking the equality of debits and credits |

| 6. Closing entries | Closing the temporary accounts |

| 7. Post-closing trial balance | Checking the equality of debits and credits |

| 8. Financial statements | Preparing the balance sheet, income statement, and statement of cash flows |

Internal Control

Internal control is a system of policies and procedures designed to protect the company’s assets, ensure the accuracy of its financial records, and promote compliance with laws and regulations.

Internal control procedures include:

- Segregation of duties

- Authorization of transactions

- Reconciliation of bank accounts

- Physical safeguards

Internal control helps to prevent fraud and errors, and ensures that the company’s financial statements are accurate and reliable.

Cash Flow Management

Cash flow management is the process of managing the company’s cash inflows and outflows.

Cash flow management techniques include:

- Forecasting cash flows

- Managing accounts receivable

- Managing accounts payable

- Investing excess cash

Cash flow management is important because it helps the company to avoid cash shortages and to maximize its profitability.

Financial Ratio Analysis: Fundamental Financial Accounting Concepts 11th Edition Pdf

Financial ratio analysis is the process of using financial ratios to assess a company’s financial health.

Common financial ratios include:

- Liquidity ratios: Measure the company’s ability to meet its short-term obligations.

- Solvency ratios: Measure the company’s ability to meet its long-term obligations.

- Profitability ratios: Measure the company’s profitability.

- Efficiency ratios: Measure the company’s efficiency in using its assets.

Financial ratio analysis can help investors and creditors to make informed decisions about a company.

FAQ Insights

What are the key principles of accounting?

The fundamental principles of accounting include the accrual basis, the going concern assumption, the matching principle, and the materiality concept.

What is the purpose of a balance sheet?

A balance sheet provides a snapshot of a company’s financial position at a specific point in time, showing its assets, liabilities, and equity.

How do adjusting entries affect financial statements?

Adjusting entries update financial statements to reflect events that have occurred but have not yet been recorded, ensuring that the statements are accurate and up-to-date.

What is the purpose of closing entries?

Closing entries transfer balances from temporary accounts (revenue and expense accounts) to permanent accounts (asset and liability accounts) at the end of an accounting period, preparing the accounts for the next period.

What is the importance of cash flow management?

Cash flow management is crucial for ensuring that a company has sufficient cash to meet its obligations and continue operating smoothly.